Oct 23, 2025

Could India be the shining example of the energy transition?

India has stated that it will be energy independent by 2047, achieving this by aggressively scaling up and strengthening renewable energy (such as solar and wind) and green hydrogen alongside grid modernisation. Natural gas will also play an increasing role as a transition fuel, with demand expected to grow by 60% by 2030. Collectively, these measures will lead to a significant reduction in the use of fossil fuels as part of its 2070 net zero target.

India is also rapidly industrialising and is determined to become a global leader in artificial intelligence (AI) by fostering a strong ecosystem through the India AI Mission, an ambition that comes with a major uptick in energy consumption. Balancing these targets requires a carefully coordinated strategy that aligns technological advancement with sustainable energy development.

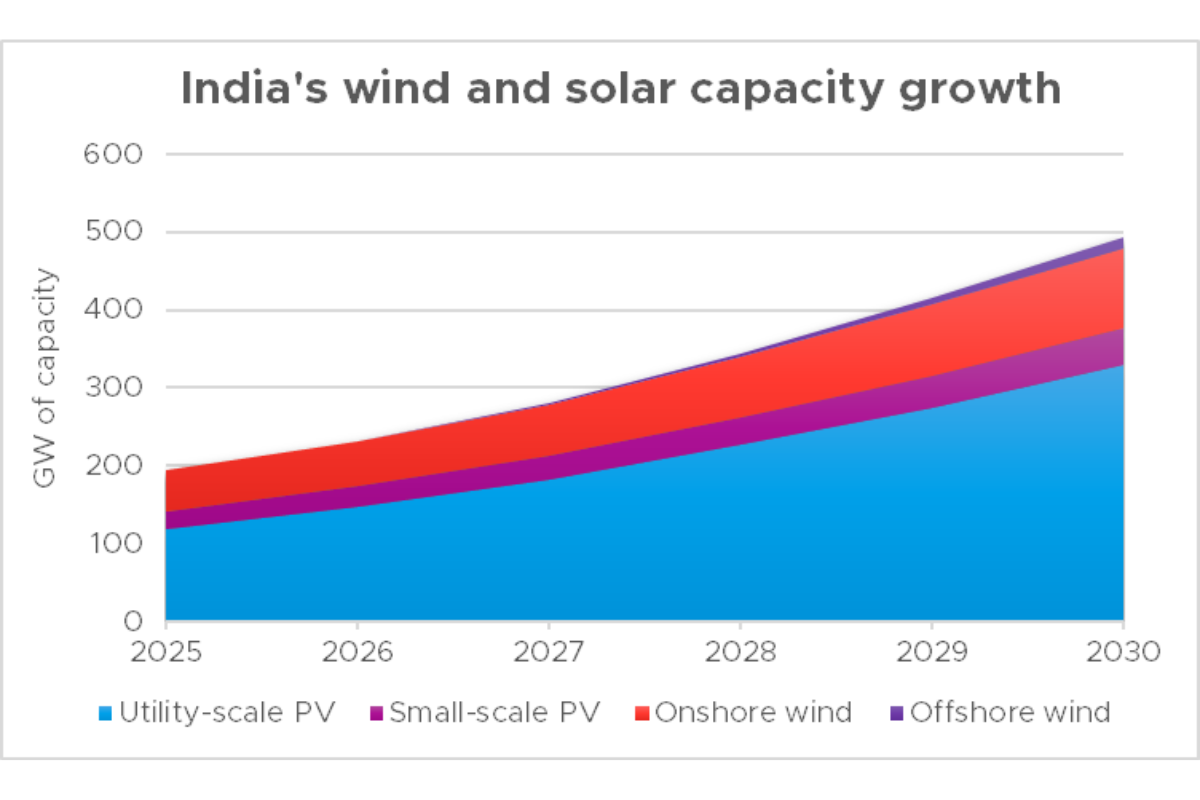

As such, India is undertaking nothing less than a total reinvention of its energy infrastructure, with the government allocating $10B for grid transmission and distribution. It also plans to become a global solar powerhouse, with a target of 500GW of non-fossil-fuel energy capacity by 2030. In parallel, the growth of natural gas is on the rise, driven by cost benefits as well as government restrictions being placed on coal with a societal objective to improve air quality.

Figure 1: India’s anticipated growth of wind and solar over the next five years. Data from BloombergNEF’s 2025 New Energy Outlook.

These energy initiatives will be essential groundwork in the building of an installed capacity of around 900GW within the next decade, to meet a power demand that is expected to reach 350-400GW.

As part of the new grid architecture, power is also being decentralised to suit the generation of renewables and will be supported by fuel cells to mitigate intermittency of supply.

The use of solid oxide fuel cells (SOFCs) can play a major role in India’s new grid: when partnered with solar and wind, they offer a clear route to ensuring continuous, affordable and reliable energy supply, supporting economic growth while achieving climate targets. By using electrochemical conversion rather than combustion, solid oxide fuel cells are almost twice as efficient as some traditional power sources. When you consider the high cost of gas in India compared to some other countries, this improved efficiency translates into significant fuel and cost savings. Solid oxide fuel cells offer a route to cleaner air with virtually no emissions compared to other traditional energy technologies. In fact, SOFCs are ideally suited for India’s power generation; offering proven reliability, longevity and fuel flexibility (as they can utilise a variety of fuels including natural gas, hydrogen and biogas). These attributes can enable utility-scale deployment of SOFC technology that will lower the burden on the grid, balance renewables and reduce capital intensive grid expansion.

India is intent on boosting domestic manufacturing for its new energy needs. Against a backdrop of geopolitical turbulence, India is putting ever increasing attention not just on the localisation of energy sources, but also on the manufacturing of critical equipment across solar PV, wind turbines and battery energy storage systems. Added to this, manufacturing of SOFC systems will assist in securing India’s energy supply chain through full vertical integration of fuel cell manufacturing, in line with the Make In India mandate. Local manufacturing of SOFC systems can answer India’s need for reliable energy to supply power-hungry data centres to fulfil its global AI ambitions.

Although India still relies heavily on coal and energy imports, it has a unique opportunity to leapfrog to the clean energy future. Unlike Western nations, the bulk of its energy infrastructure is yet to be built, so it starts from an advantageous position. SOFC has all the right attributes to support India in achieving its goals and India has the ambition, drive and vision to succeed.